PDF chapter test TRY NOW

Nature of Money

Money is a difficult concept to define because it fulfils not one but three functions, those are

- A unit of account

- A medium of exchange and

- A store of value

Some economists define money in legal terms saying that “anything which state declares as money is money”. This means that country has the authority to declare money.

Functions of Money

- Primary or Main function

- Secondary function

- Contingent function

Primary or main functions:

i) Medium of exchange or means of payment - Money is used to buy goods and services.

i) Medium of exchange or means of payment - Money is used to buy goods and services.

ii) Measure of value - All the values are expressed in terms of money. Thus, it is easier to determine the rate of exchange between various type of goods and services.

Secondary functions:

i) Standard of deferred payment - Money helps the future payments too. Today, a borrower borrowing places himself under an obligation to pay a specified sum of money on some specified future date.

ii) Store of value or store of purchasing power - Savings were discouraged under the barter system as some commodities are perishable. The introduction of money has helped to save it for the future as it is non-perishable.

iii) Transfer of value or transfer of purchasing power - Money makes the exchange of goods to distant places as well as abroad possible. It was, therefore, felt necessary to transfer purchasing power from one place to another.

Contingent functions:

1. Basis of credit

2. Increase productivity of capital

3. Measurement and Distribution of National Income

1. Basis of credit

2. Increase productivity of capital

3. Measurement and Distribution of National Income

Inflation and Deflation

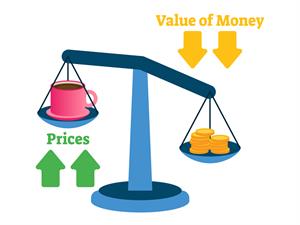

Inflation refers to the prices are rising, the value of money will fall.

Deflation refers to the prices are falling, the value of money will rise.

Inflation refers to the prices are rising, the value of money will fall.

Deflation refers to the prices are falling, the value of money will rise.

Inflation