PUMPA - SMART LEARNING

எங்கள் ஆசிரியர்களுடன் 1-ஆன்-1 ஆலோசனை நேரத்தைப் பெறுங்கள். டாப்பர் ஆவதற்கு நாங்கள் பயிற்சி அளிப்போம்

Book Free DemoCredit:

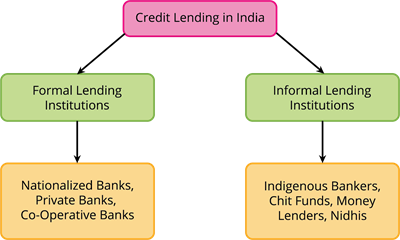

Credit is the amount given to an individual or the company to enhance their business or standard of living. In India, the credit-issuing authorities are vested with the banks, which play a crucial role in extending the net of financial inclusion in society.

The Indian economy consists of two types of credit lending institutions that moderate money circulation among the public.

Formal Lending Institutions:

Banks that are nationalised in two-time frames \(1969\) and \(1980\) play a huge role in extending credit allotted for them by the respective government programs.

Bank in India

Rural banks and Cooperative Banks extend the net of inclusion of people of the rural economy with the banking systems by availing loans and another form of credit which enhances their lives and livelihood.

Private banks extend loans to Urban companies under certain conditions that help in nurturing the Urban Economy.

Informal Credit Institutions:

The Informal credit institutions function as parallel credit lenders who, on the other side, issue credits to the needy and poor who are unaware of the Banking institutions..

Most of the informal credit institutions function under the roof of trust among the lender and the receiver. Some of the functioning informal credit institutions in India are explained below.

1. Indigenous Bankers:

These are private firms or individuals who accept deposits from their customers and lend money as loans. These functions made them similar to the banks.

Most of these Indigenous bankers function along with the urban areas of India's western and southern parts. Their credit lending practices are unregulated.

The dominance of the formal banking sector had considerably reduced the importance of Indigenous bankers over the years.

2. Money Lenders:

Money lenders are wealthy individuals capable of lending huge sums of money with a high rate of interest. They operate in both urban and rural areas. Most of their credit lending activities will be around poor farmers who lack livelihood.

Later, the Government of India enacted numerous acts and stringent measures to curb money lending activity in India.

3. Self-Help Groups (SHG):

An SHG in India

These are informal groups of people who assemble themselves financially to sort out a common problem. Most of the SHGs are formed to root out the problem of unemployment.

The NABARD (National Bank for Agriculture and Rural Development) formed a pilot project named “SHG-Bank Linkage Project'' in \(1992\). This project is currently believed to be the World’s largest Microfinance Project.

The banks financially aid people belonging to similar socio-economic backgrounds from these groups through the system of Micro-Credit.

4. Chit Funds:

Chit funds are local institutions run by the people belonging to the same place. These are money-saving institutions through periodic subscriptions by the regular members.

The beneficiary of the month is selected by drawing lots by random people present at that time. This method is highly popular in areas of Tamil Nadu and Kerala.

Reference:

An SHG in India: ABIR ROY BARMAN / Shutterstock.com

Bank in India: Harshit Srivastava S3 / Shutterstock.com

Bank in India: Harshit Srivastava S3 / Shutterstock.com